Below are FAQs with respect to small business assistance under the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) program.

- Q: If my business is owned by a large company or private company with adequate sources of liquidity to support my business’s ongoing operations, can my business qualify for a PPP loan?

-

- In addition to reviewing applicable affiliation rules to determine eligibility, you must assess your economic need for a PPP loan under the standard established by the CARES Act and the PPP regulations at the time of the loan application.

- Although the CARES Act suspends the ordinary requirement that borrowers must be unable to obtain credit elsewhere, you still must certify in good faith that your PPP loan request is necessary.

- Specifically, before submitting a PPP application, you should carefully review the required certification that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant.”

- You must make this certification in good faith, taking into account your current business activity and your ability to access other sources of liquidity sufficient to support your ongoing operations in a manner that is not significantly detrimental to the business.

- Q: How much funding can I receive?

- A maximum loan amount of 2.5 times your business’s average total monthly “payroll costs” (capped at $10 million total) plus the outstanding amount of an Economic Injury Disaster Loan (EIDL) less any “advance” under an EIDL Grant.

- “Payroll costs” include more than annual salaries. They also include group healthcare insurance premiums, retirement benefits, and vacation, paternal, family, medical and sick leave payments .

- The loan proceeds may be used beyond “payroll costs” to cover salaries, commission or similar compensation, as well as utilities, lease payments, mortgage interest payments (but not prepayment of or payment of principal), payments of interest on other debt obligations, and refinancing of EIDLs. However, these expenses are not included in the calculation of “payroll costs” to determine the loan amount.

- Amounts used for non-payroll costs may impact loan forgiveness (see below).

- Q: Does the cost of a housing stipend or allowance provided to an employee as part of compensation count toward payroll costs?

-

- Yes. Payroll costs includes all cash compensation paid to employees, subject to the $100,000 annual compensation per employee limitation

- Q: How is the loan forgiveness decision made?

-

- If, after you submit a complete application, your lender determines that you are entitled to forgiveness of some or all the amount you applied for, your lender must request payment from SBA.

- SBA will, subject to any SBA review of the loan or loan application, remit the appropriate forgiveness amount to your lender, plus any interest accrued through the date of payment, within ninety (90) days after your lender issues its decision to SBA.

- If SBA determines in the course of its review that you were ineligible for the PPP loan based on the provisions of the CARES Act, SBA rules or guidance available at the time of your loan application, or the terms of your PPP loan application (for example, because you lacked an adequate basis for the certifications made), the loan will not be eligible for loan forgiveness.

- If only a portion of the loan is forgiven, or if the forgiveness request is denied, you must repay any remaining balance due on the loan on or before the maturity date of the loan.

- Q: If I restore reductions made to employee salaries and wages or FTE employees by June 30, 2020, can I avoid a reduction in my loan forgiveness amount?

-

- Yes. If certain employee salaries and wages were reduced between February 15, 2020 and April 26, 2020 but you eliminate those reductions by June 30, 2020 at the latest, you are exempt from any reduction in loan forgiveness amount that would otherwise be required due to reductions in salaries and wages.

- Similarly, if you eliminate any reductions in FTE employees by June 30, 2020 at the latest, you are exempt from any reduction in loan forgiveness amount that would otherwise be required due to reductions in FTE employees.

- NOTE: The Paycheck Protection Program (PPP) Flexibility Act of 2020 (H.R. 7010) was recently signed into law by the President, which extends the June 30th deadline by which employers can restore staff reductions to December 31, 2020.

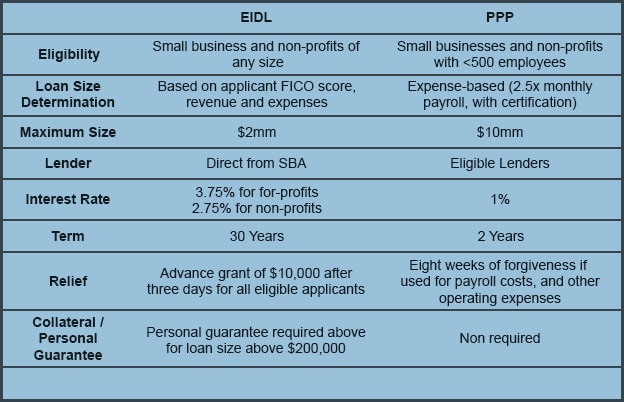

- Q: What are the key differences between Economic Injury Disaster Loan (EIDL) and Payroll Protection Program (PPP)?